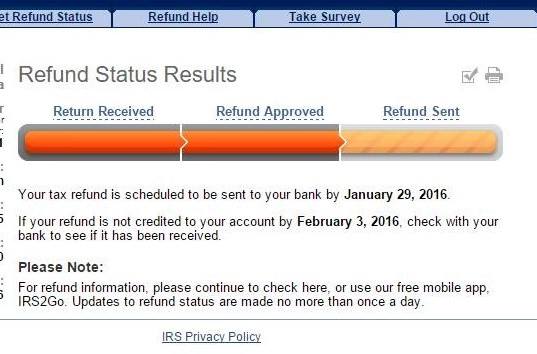

However, in some cases, processing could take up to 16 weeks. Individual Income Tax Return, is between 8 and 12 weeks from the time the IRS receives your tax return. The normal processing time for Form 1040-X, Amended U.S.

AMENDED TURBOTAX RETURN HOW TO

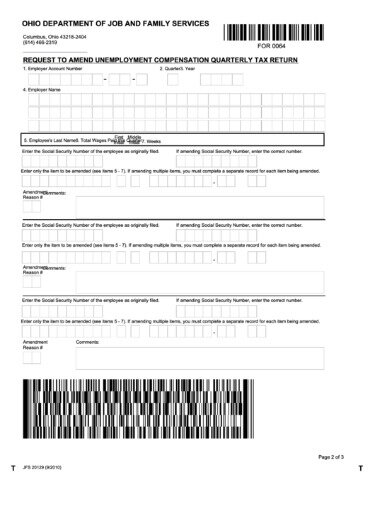

For information on how to correct your state tax return, contact your state tax agency. Your state tax amount may be affected by changes on your federal tax return.

AMENDED TURBOTAX RETURN FULL

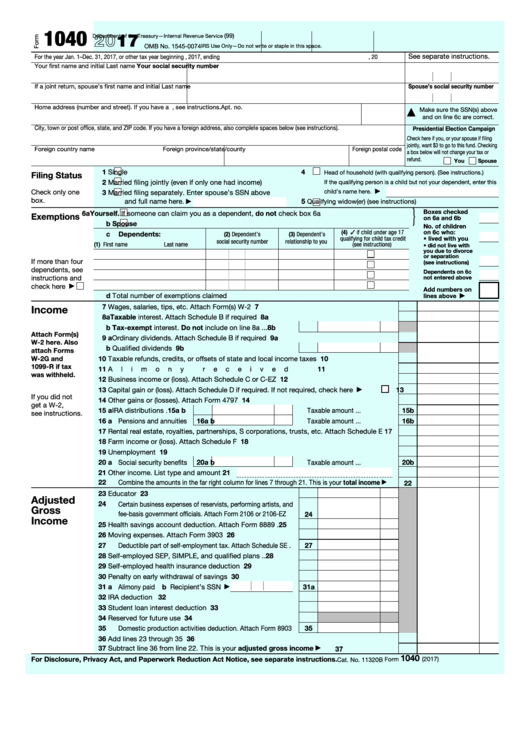

If you can’t make partial or full payment, there may be other options. If you owe a balance, make a payment with the amended tax return, if possible.Generally, unless there’s a special situation or you’re submitting your form in response to an IRS notice, send it to the same IRS address where you filed your original return. If filing by paper, mail all documents using the “Where to File” information in the IRS Form 1040-X Instructions.Attach/include copies of all forms and schedules that you’re changing.Amended returns for other years must be filed by paper.

AMENDED TURBOTAX RETURN SOFTWARE

You should contact your preferred tax software provider to verify their participation and for specific instructions needed to submit your amended return and to answer any questions. If you need to amend your 2019, 20 Forms 1040 or 1040-SR you can do so electronically using available tax software products, as long as you e-filed the original return. Be sure to read the “Special Situations” section for instances that have special conditions or rules you need to follow.

If all you need to do is change your address, IRS.gov’s Address Changes page lists all available options. When the IRS sends you a notice about errors, there are usually other ways to correct errors besides an amended tax return.

See Incorrect Tax Return for more information. The notice will tell you about the error and what information (if any) you need to submit to the IRS to correct it. If the IRS finds mistakes like a math error or missing schedule before you do, you’ll get an IRS notice. It changes your original return to include new information. When you file Form 1040-X for a tax year, it becomes your new tax return for that year. However, there are exceptions to the rule in some situations, such as: Generally, in order for IRS to be able to issue a refund, you must amend your return within three years (including extensions) after the date you filed your original return or within two years after the date you paid the tax, whichever is later.

In this case, you may be able to use Form 1045, Application for Tentative Refund instead of Form 1040-X, which will generally, result in a quicker refund. You can also amend your return to claim a carryback due to a loss or unused credit. If you’re unsure if you should file an amended return, you can use this tax tool to help you decide. If so, you would file an amended return to change the amounts adjusted by IRS. Or, IRS may have made an adjustment to your return, and sent you a notice that you disagree with. Individual Income Tax Return.įor example, a change to your filing status, income, deductions, credits, or tax liability means you need to amend your return. If you realize there was a mistake on your return, you can amend it using Form 1040-X, Amended U.S.

0 kommentar(er)

0 kommentar(er)